ഇന്കം ടാക്സ് ഇ-ടിഡിഎസ് ഫയലിംഗ് നടത്താനായി BIN View നോക്കാനായി ഇപ്പോള് AIN നമ്പര് ആവശ്യമാണ്.

Sl

No Name Of Treasury AIN

1 District Treasury Chengannoor 1045881

2 District Treasury Ernakulam 1045936

3 District Treasury Idukki 1045925

4 District Treasury Kasargod 1046054

5 District Treasury Kollam 1045855

6 District Treasury Kottayam 1045903

7 District Treasury Muvattupuzha 1045940

8 District Treasury Palakkad 1045973

9 District Treasury Alappuzha 1045870

10 District Treasury Malappuram 1045995

11 District Treasury Thrissur 1045951

12 DISTRICT TREASURY PATHANAMTHITTA 1045892

Click here to view AIN code of all TREASURIES in kerala

ടി ഡി എസ് സ്റ്റേറ്റ്മെന്റ് ഫയല് ചെയ്യാന് സഹായം ആവശ്യമാണോ? - ഇവിടെ ക്ലിക്ക് ചെയ്യൂ ..

Sl

No Name Of Treasury AIN

1 District Treasury Chengannoor 1045881

2 District Treasury Ernakulam 1045936

3 District Treasury Idukki 1045925

4 District Treasury Kasargod 1046054

5 District Treasury Kollam 1045855

6 District Treasury Kottayam 1045903

7 District Treasury Muvattupuzha 1045940

8 District Treasury Palakkad 1045973

9 District Treasury Alappuzha 1045870

10 District Treasury Malappuram 1045995

11 District Treasury Thrissur 1045951

12 DISTRICT TREASURY PATHANAMTHITTA 1045892

Click here to view AIN code of all TREASURIES in kerala

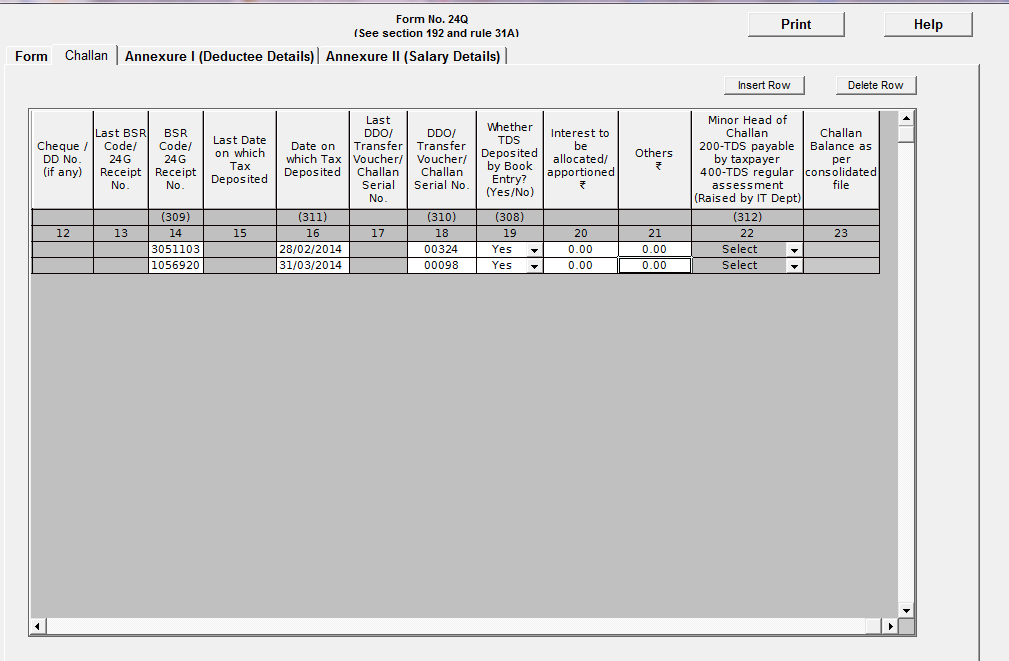

- Click Here To view BIN details (provide TAN, AIN, Nature of Payment , Form 24G month/year range)

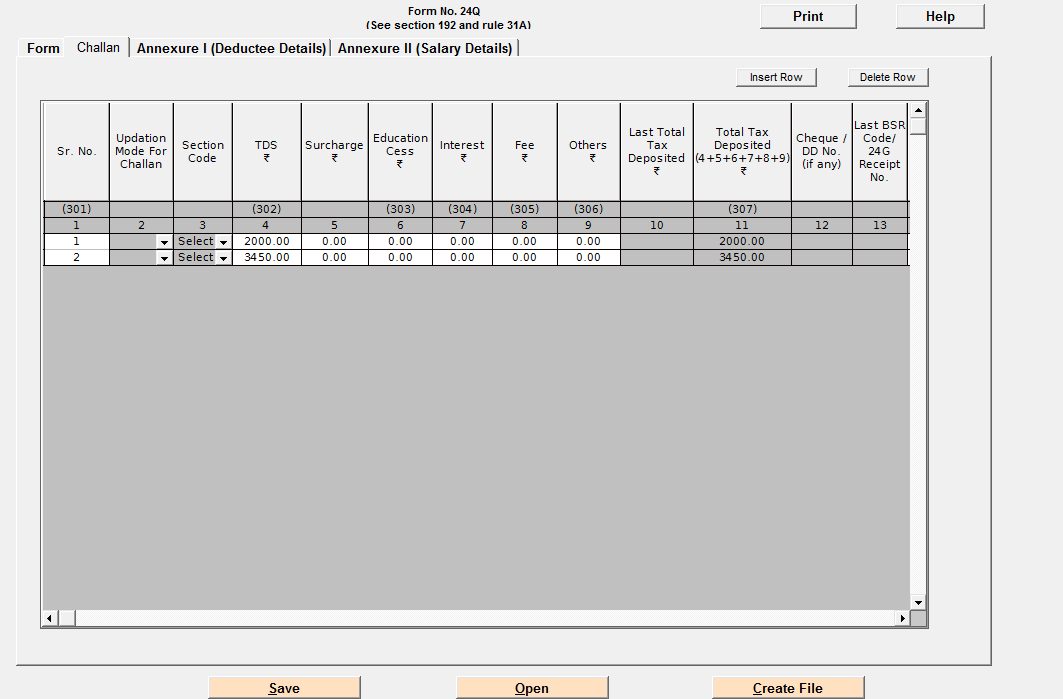

- BIN is to be quoted in the Transfer voucher details while preparing the quarterly TDS/TCS statements.

- Period selected should be within 15 months.

- BIN view is available for Form 24G filed for F.Y. 2010-11 onwards.

- If BIN details for mentioned AIN and period are not available then please contact your respective Pay and Accounts Office (PAO)/ District Treasury Office (DTO) to whom the TDS/TCS is reported.

- BIN consists of the following:

- Receipt Number: Seven digit unique number generated for each Form 24G statement successfully accepted at the TIN central system.

- DDO Serial Number: Five digit unique number generated for each DDO record with valid TAN present in the Form 24G statement successfully accepted at the TIN central system.

- Date: The last date of the month and year for which TDS/TCS is reported in Form 24G.

ടി ഡി എസ് സ്റ്റേറ്റ്മെന്റ് ഫയല് ചെയ്യാന് സഹായം ആവശ്യമാണോ? - ഇവിടെ ക്ലിക്ക് ചെയ്യൂ ..

RSS Feed

RSS Feed